Monte Carlo Pricing Method of European Call (Python)

- 2016年2月26日

- 讀畢需時 1 分鐘

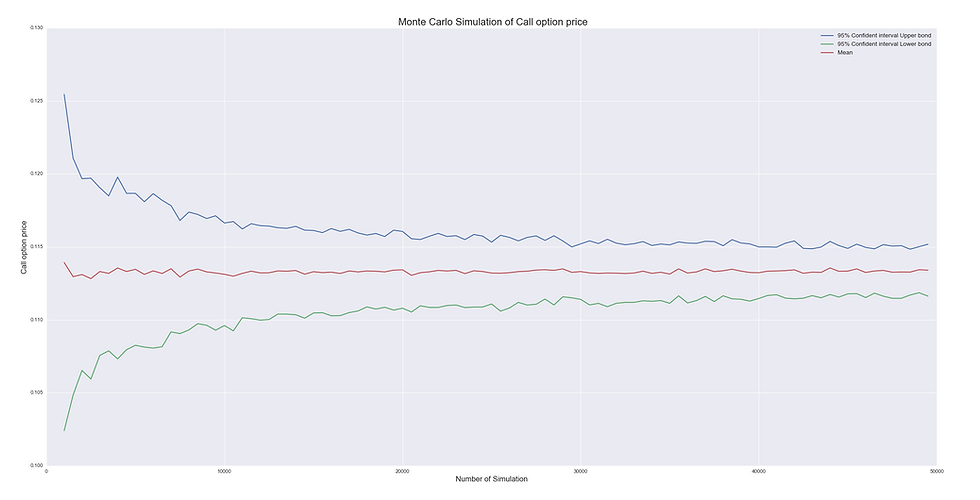

Assuming the underlying stock follows the geometric Brownian process, with some easy Ito calculus, we can actually produce perfect Monte Carlo estimator of the E call option. I omitted the calculus part, since it is trivial. Below is the code and the estimator convergence speed result:

*******************************************************************

#encoding=utf-8 import numpy as np import time from scipy.stats import norm import matplotlib.pyplot as plt import seaborn as sns from math import*

def GORB(a): if a<5: return "soso" else: return "too slow!"

#B-S parameters : S=2.45 K=2.50 t=0.25 r=0.05 sigma=0.25 # Portfolio=range(0,5000,500)

def BS(S,K,t,r,sigma): d1=(log(S/K)+(r+0.5*sqrt(sigma))*t)/(sigma*sqrt(t)) d2=d1-sigma*sqrt(t) return S*norm.cdf(d1)-K*exp(-r*t)*norm.cdf(d2)

def npBS(S,K,t,r,sigma): d1=(np.log(S/K)+(r+0.5*sqrt(sigma))*t)/(sigma*sqrt(t)) d2=d1-sigma*sqrt(t) return S*norm.cdf(d1)-K*exp(-r*t)*norm.cdf(d2)

def func1(S,t,r,sigma): plt.figure(1) sns.set_style("ticks") time_series=[] for i in Portfolio: strike_series=np.linspace(2.0,3.0,i) time_now=time.time() for x in range(i): BS(S,strike_series[x],t,r,sigma)

time_series.append(time.time()-time_now)

plt.bar(Portfolio,time_series, color="red",width=200) plt.plot() plt.show() plt.title("Computation running time of option's portfolio-Loop method") time_series=np.asarray(time_series) print "for loop运行时间(s):",time_series.sum(),"。。。血崩" def func2(S,t,r,sigma): time_series=[]

for i in Portfolio: strike_series=np.linspace(2.0,3.0,i) time_now=time.time() npBS(S,strike_series,t,r,sigma) time_series.append(time.time()-time_now)

plt.bar(Portfolio,time_series, color="red",width=200) plt.plot() plt.title("Computation running time of option's portfolio-Numpy method") plt.show()

time_series=np.asarray(time_series) print "vector运行时间(s):",time_series.sum(),"。。。有点吊"

# func1(S,t,r,sigma) # func2(S,t,r,sigma)

# Stock price follows geometric brownian motion, pricing call option using monte carlo def MonteCarlo(S,t,r,sigma,K,path): raw_simulators=norm.rvs(size=path,loc=(r-0.5*sigma**2)*t,scale=sigma*sqrt(t)) raw_simulators=S*np.exp(raw_simulators) simulators=np.maximum(raw_simulators-K,0.0).sum() price=exp(-r*t)*simulators/path return price

# print MonteCarlo(S,t,r,sigma,K,10000)

def MonteCarloConvergenceSpeed(S,t,r,sigma,K): size=100 pathscenario=range(1000,50000,500) UpperBond=[] LowerBond=[] mean=[] timemark=time.time() for path in pathscenario: result=[] for simu in range(size): result.append(MonteCarlo(S,t,r,sigma,K,path)) result=np.asarray(result) mean.append(result.mean()) LowerBond.append(result.mean()-1.96*result.std()) UpperBond.append(result.mean()+1.96*result.std()) line_table=np.asarray([UpperBond,LowerBond,mean]).T plt.plot(pathscenario,line_table) plt.title(" Monte Carlo Simulation of Call option price",fontsize=20) plt.xlabel("Number of Simulation",fontsize=15) plt.ylabel("Call option price",fontsize=15) plt.legend(["95% Confident interval Upper bond","95% Confident interval Lower bond","Mean"],fontsize=12) timemark=time.time()-timemark

t=GORB(timemark) print "Running Time: ",timemark,t plt.show()

MonteCarloConvergenceSpeed(S,t,r,sigma,K)

see the result:

留言